Explore the limitless ocean of NFTs with YFNFT Minting Model. Non-Fungible Tokens are bringing Binance Smart Chain blockchain applications to the mainstream. In this article, we will cover following points and context in details.

- A short introduction to the current market scenario

- What is NFT, who can create NFTs and how are NFTs made?

- Binance Smart Chain and YFNFT Minting Model

- Best application to use while NFT minting and trading

- YFNFT Minting Process

Introduction

The advanced in art and graphic distribution is now popular as a Non-Fungible Token, due to its unique value, built and stored on the blockchain. Mainly, NFTs are created, traded and stored on the Binance blockchain however, there are several other tokens that can leverage the creation and storage of NFTs. For the YFNFT Minting Model let’s consider the Binance blockchain.

What is an NFT?

An NFT portray any digital file including but not limited to:

- Art and Collectible Items

- In-game tokens

- Video and Audio

Who can Create NFTs and How to Make NFTs?

Any enthusiasts who possess the ability to create a digital file can freely mint an NFT. The person interested in creative designs and collections can get their hands-on using any trusted minting platform.

If the user can easily access a device to surf online items and data or a person with a little amount of patience can make their very own NFT. Not only make the NFTs but also can proceed to opt for a sale.

Binance and Minting NFTs

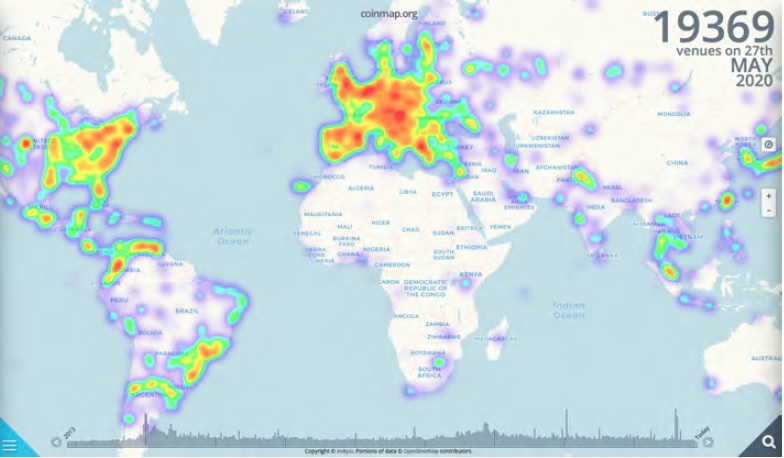

There are diverse blockchains and crypto assets that can create, trade, and store NFTs, wherein, in the current framework Binance Smart Chain is the most popular, trusted network. This blockchain enables your NFT to be affordably and easily traded in NFT marketplaces that can be considered as online store to purchase and reserve NFTs.

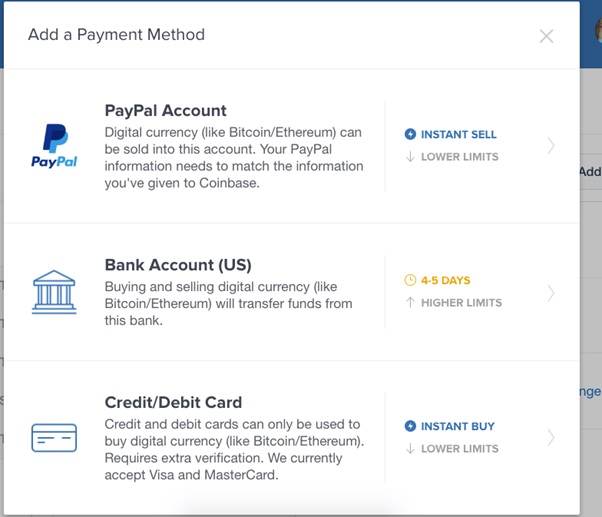

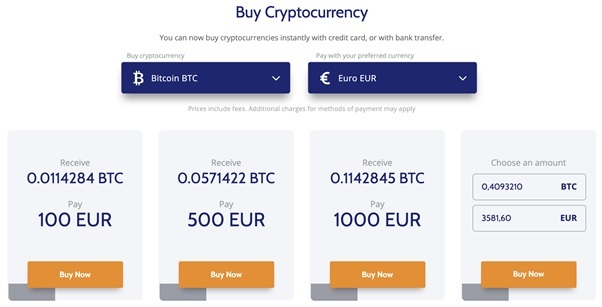

The user needs a crypto wallet containing BNB to create, trade or mint an NFT. You should initially buy Binance tokens by trading on top recommended exchanges. Else, you can opt for the more prudent approach i.e., purchasing Binance assets using fiat currency like the US Dollar to mint the NFT.

The least recommended amount to budget for NFT minting should be $100 USD in BNB per NFT you want to mint, however, based on the complexity of your NFT, you might look for allocating a larger amount. Though, $100 seems a good base minimum.

Best Application to Use to Mint and Trade NFTs

The easy and most suggested decentralized application to use while minting your NFT is Metamask. Metamask is basically a free app available in Google Play store as well as iTunes.

Mint Your NFT On YFNFT Minting Model

YFNFT DApp does not charge a fee to mint an NFT, however, the user needs to pay a fee depending on the final sale price of your NFT. The payment tokens are utilized to purchase and sell your NFTs. This project supports Binance smart tokens and other crypto coins for trades.

More importantly, the user should connect their crypto wallet to start minting, buying, and selling of NFTs. We highly recommend Metamask wallet to use on YFNFT Minting App, however, any BSC supported crypto wallets are acceptable on YFNFT Minting Model.

YFNFT Minting Process

We offer fairly straightforward minting process for your NFTs.

Getting Started

Visit the YFNFT Minting official site, check for an option to-

- Explore/create an NFT

- Few exclusive YFNFT drops

- Trending NFTs

- Resources to get started

- Browse by categories

Connect your Metamask wallet

- To create a YFNFT account you need to connect your Metamask wallet.

- Click on the wallet icon located at the top-right corner

- You will find a list of supported wallets

- Select Metamask from the list

Once you connect the wallet, you need to set up your profile by feeding a username, profile image, cover and other required details to proceed. Sign in to each update using your Metamask account to apply the necessary changes to your YFNFT Minting account.

Explore and Purchase an NFT

You can now start exploring the NFTs that creators mint across the domain browsing by category / clicking on Marketplace and searching for All NFTs.

To buy an NFT, select an asset from the given list. The user also has a chance to apply filters for price sorting, categories, etc.

Click on ‘Buy Now’, and agree to the YFNFT Minting Model terms.

Metamask will show you a pop up to authenticate your transaction. It will also display the gas costs for proceeding the transaction.

Tap on ‘Accept’, and wait a few moments to confirm your purchase on the Binance blockchain.

You can cross check the BSC link to make sure, and verify the asset is shown in your Metamask wallet and your YFNFT profile as well.

Minting an NFT

We have a simple 4-step procedure to mint your initial NFT collection. As we have already connected a wallet and set up the user profile, move on to the ‘Create’ section for adding your assets.

The user needs to add an appealing description, social links / profile, and banner images. You can freely choose fixed-price listings, auctions, and declining-price listings.

Check out a quick rundown on how to mint your own NFT: –

- Create a collection

Add some details including name, images, URL [link], description, blockchain with respect to the NFT and payment tokens etc.

- Add a new item to your collection

Add a description and other required details related to a particular item like supply limit.

- Set prices and post your listing

The user has an option to set a highest bid, fixed price, or bundle to list their NFT.

- Confirm from your wallet

Sign the transaction using your wallet which will ask for gas fees. Once done, your item will be finally listed for sale on our YFNFT marketplace.

Congratulations on minting your NFT!

Presale of YFNFT Tokens

The YearnNFT Finance project recently initiated their YFNFT token presale to distribute 40% of the total token supply. This presale was divided into 2 Rounds- Round 1 and Round 2 respectively, each allocated with 20% token supply.

Though Round 1 was a great success, we are headed with Round 2 with a price of 1 YFNFT = 0.16 BNB. The YFNFT token presale is destined to extend due to the market hike in prices and user demands to stretch the closing date.

We will inform you about the end details once decided and the announcement will be made officially. Looking forward to your participation in this event to make it more successful and enormous.

YFNFT Minting Final Thoughts

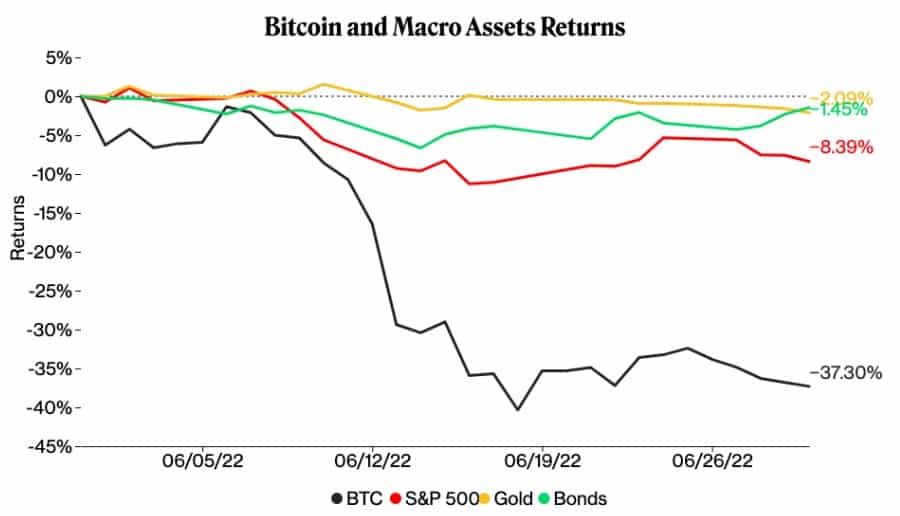

NFTs are seen attaining strong moment in the form of an emerging asset class. Though this domain is volatile, as per expert’s prediction it will be very lucrative for new beginners and traders.

If you are among the personalities that can create digital art, YFNFT minting can be your new revenue stream that you won’t regret. No, this instance, go forth, mint your NFTs, collect the points/rewards, and make tons of money with YFNFT Minting Model.

Follow our social media channels for more updates and stay tune.

Twitter | Telegram | Medium | Reddit | Facebook | Official Website